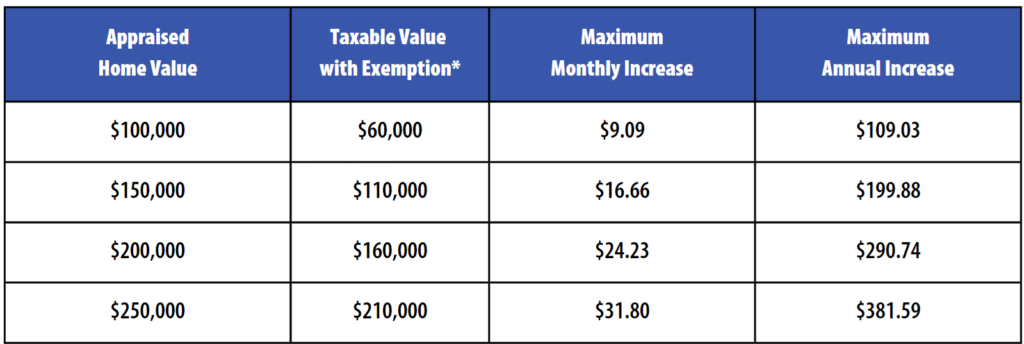

PLEASE NOTE: The projected tax increase is an estimate based on the passage of the bond propositions. This is not an official quote.

Voters 65 and Over: Under state law, if you applied for and received the Age 65 Freeze on your homestead, your school taxes CANNOT be raised unless you make significant improvements or additions to your home.

EXEMPTIONS: Estimates are calculated based on the taxable value of your home, factoring in the $40,000 Homestead Exemption. For example, a $100,000 home would have a taxable value of $60,000